Navigating the DPDP Act: A Deep Look at Data Minimization in Digital Payments

India’s digital payments revolution is boosting convenience and financial inclusion, largely thanks to platforms like the Unified Payments Interface (UPI). This rapid expansion has opened the door for millions—including those in rural areas—to embrace online transactions, fostering new economic possibilities. Yet, while the volume of personal information collected continues to grow, the real concern isn’t simply the quantity of data but rather how securely that data is managed. In May 2024, UPI recorded a remarkable 14.04 billion transactions, a record 49% year-on-year increase. This surge underscores the growing preference for digital payments among Indian consumers and businesses.

The Digital Personal Data Protection (DPDP) Act takes aim at this security challenge by making data minimization a top priority, requiring organizations to collect and process only what’s strictly needed for a specific purpose. Understanding how your organization can adhere to this principle is vital for long-term compliance, especially as the digital payments landscape continues to transform India’s financial ecosystem. As banks, payment gateways, and other entities handle these increasing volumes of data, potential risks to user privacy and security rise in tandem. Cybercriminals have every incentive to target large datasets, and a single breach can quickly impact interconnected systems. Without solid safeguards, the fallout can be severe—from eroded trust and financial losses to reputational harm and potential regulatory penalties. Once users question your ability to safeguard their data, they’ll seek alternatives, and lost confidence is hard to regain.

To address these concerns, the DPDP Act establishes a framework that promotes responsible data handling. It gives consumers more control over their personal data and holds organizations accountable for the way they collect, store, and process that data.

Understanding the DPDP Act: Key Components

The DPDP Act defines clear roles for those involved in handling personal data:

- Data Fiduciaries decide how and why personal data is processed. In digital payments, this includes banks, fintech companies, and e-commerce platforms.

- Data Processors work on behalf of Data Fiduciaries, dealing with activities like data storage and payment processing.

- Data Principals are the individuals—customers or users—whose personal data is being processed.

A core principle of the DPDP Act is data minimization, which states that organizations should collect only the personal data strictly necessary for a specified, transparent purpose. This restriction helps limit potential harm if breaches occur and fosters a stronger culture of privacy and accountability.

Why Data Minimization Matters in Digital Payments

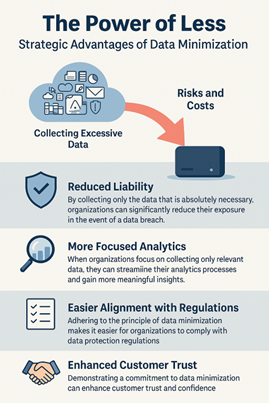

Given the constant flow of data in digital payments and its role in driving insights and strategy, it may seem counterintuitive to limit data collection. Many organizations believe more data means better decisions. In reality, this can create a “data liability” scenario with serious implications:

Enhanced Trust and Transparency

When users know a payment platform collects only what it truly needs, they’re more willing to adopt and trust that platform. Clear communication about what data is collected and why helps build confidence and encourages broader participation in digital transactions.

Reduced Exposure and Risk

Organizations that hold large amounts of unnecessary information become more attractive targets for cyberattacks. By limiting data collection, they shrink the attack surface and minimize potential damage if a breach ever happens.

Streamlined Compliance

Compliance with data protection laws becomes far more manageable when an organization isn’t overloaded with superfluous personal data. This streamlined approach not only reduces legal risk but also allows teams to invest more energy in innovation and service improvements.

More Focused and Efficient Analytics

Gathering endless data doesn’t automatically lead to better decisions. When you focus on what’s truly relevant, analytics become easier, faster, and more accurate. A digital payment platform evaluating fraud, for example, can build more precise models if it zeroes in on pertinent metrics rather than sifting through irrelevant user details.

Reduced Liability

The fewer data points an organization holds, the less damage a breach can inflict. Organizations that adhere to data minimization also demonstrate greater diligence to regulators, reducing the likelihood of hefty fines if incidents occur.

Implementing Data Minimization in Practice

Achieving data minimization isn’t a “set it and forget it” task; it’s an ongoing process that calls for thoughtful planning and consistent updates:

- Define Your Purpose

Make sure every piece of personal data you gather aligns with a legitimate, clearly stated goal. If data doesn’t contribute to that purpose, don’t collect it. - Review Products and Processes

Regularly assess any point where data is collected—from user registration forms to transaction logs. Remove unnecessary fields that don’t serve a core function. - Conduct Privacy Impact Assessments

Before launching new products or features, evaluate how they might affect user privacy. If certain data points aren’t essential, don’t collect them. - Use AI Responsibly

Artificial intelligence can enhance risk assessment, but feeding it irrelevant or excessive personal information can undermine user privacy. Train AI models only on data that’s strictly relevant to their intended tasks. - Give Users Control

Ensure that users understand exactly what data is being collected and why, also give them the ability to withdraw consent easily if they choose to. This transparency builds credibility and respect for a platform. - Limit Storage

Don’t keep data beyond its useful life. Once a transaction is completed or a legal requirement has been met, consider secure deletion or anonymization to reduce the risk of unauthorized access.

Data Minimization as a Strategic Imperative

Data minimization is more than just a regulatory requirement; it’s a strategic decision that can elevate user trust, reduce business risks, and support a secure, thriving digital payments environment. By collecting only what you truly need, you protect customers, streamline your compliance efforts, and ultimately strengthen your relationship with regulators and users alike.

Data breaches are becoming distressingly common, embracing data minimization can set you apart as an organization that genuinely respects individual privacy. Combined with other DPDP Act principles—such as strong consent management, privacy by design, and prompt breach notification—it provides a robust way to safeguard personal information at every stage of the digital transaction journey. Adopting this holistic, privacy-focused strategy helps create a more resilient digital payments ecosystem where users feel confident about entrusting their data to your organization. If you’re interested in setting your organization on the path to be compliant with evolving regulations – get in touch with us by clicking here.

USA

USA India

India APAC

APAC Middle East

Middle East Global

Global

Facebook

Facebook Linkedin

Linkedin  X

X Youtube

Youtube