Acquirer-led Investigations, Backed by SISA Sappers

Our accredited forensic team supports acquirers with structured investigations that meet card scheme mandates, uncover root causes, and safeguard the digital payment ecosystem.

Acquirer-led Investigation

When payment fraud or a suspected compromise affects merchants, card networks often mandate the acquiring bank to lead the investigation.

An Acquirer-led Investigation follows a structured, regulator-aligned process to validate the incident, assess risks, and determine responsibilities. These investigations safeguard the payment ecosystem by ensuring PCI DSS compliance, protecting cardholder data, and enforcing accountability across merchants and service providers.

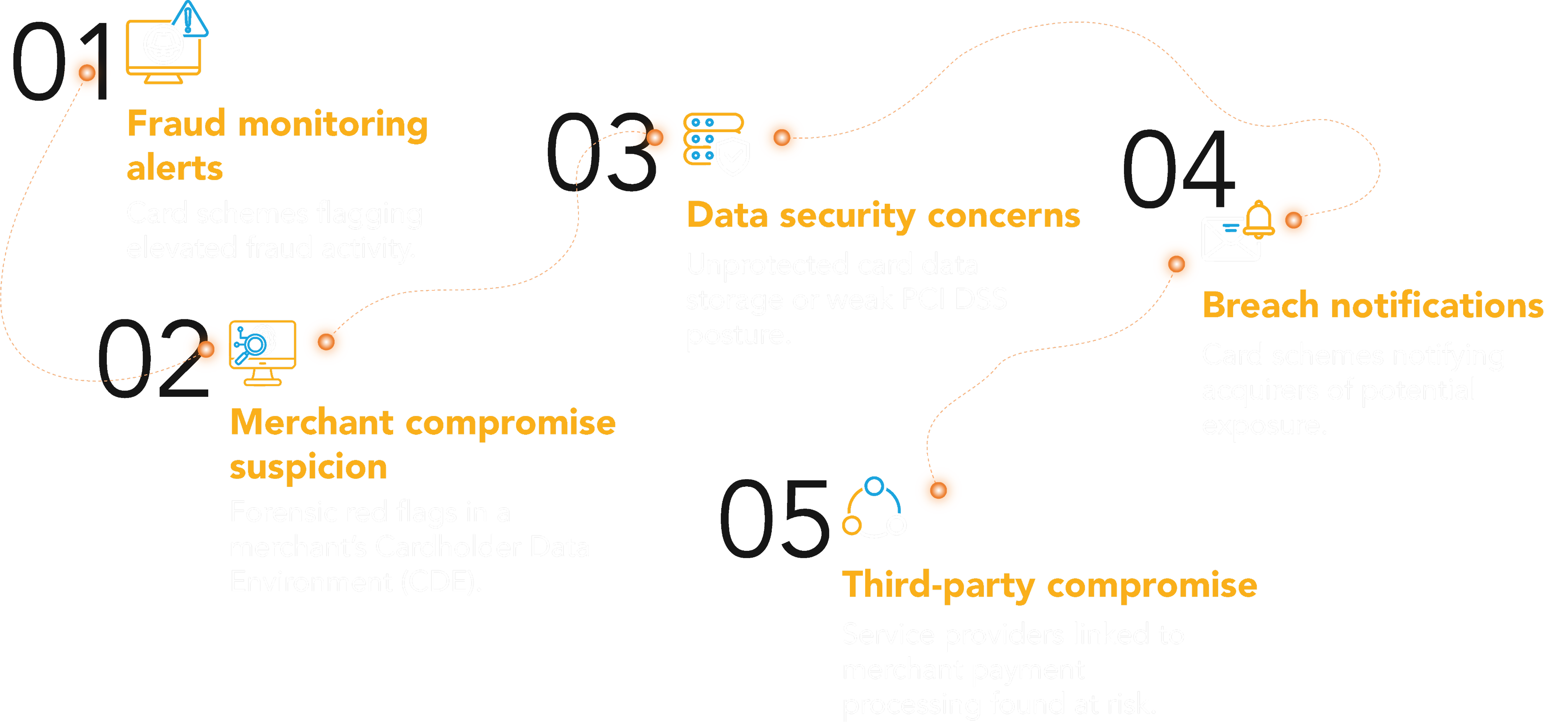

When is an Acquirer-led Investigation required?

Acquirer-led investigations are initiated when card networks identify unusual fraud patterns linked to a merchant or service provider. Common triggers include:

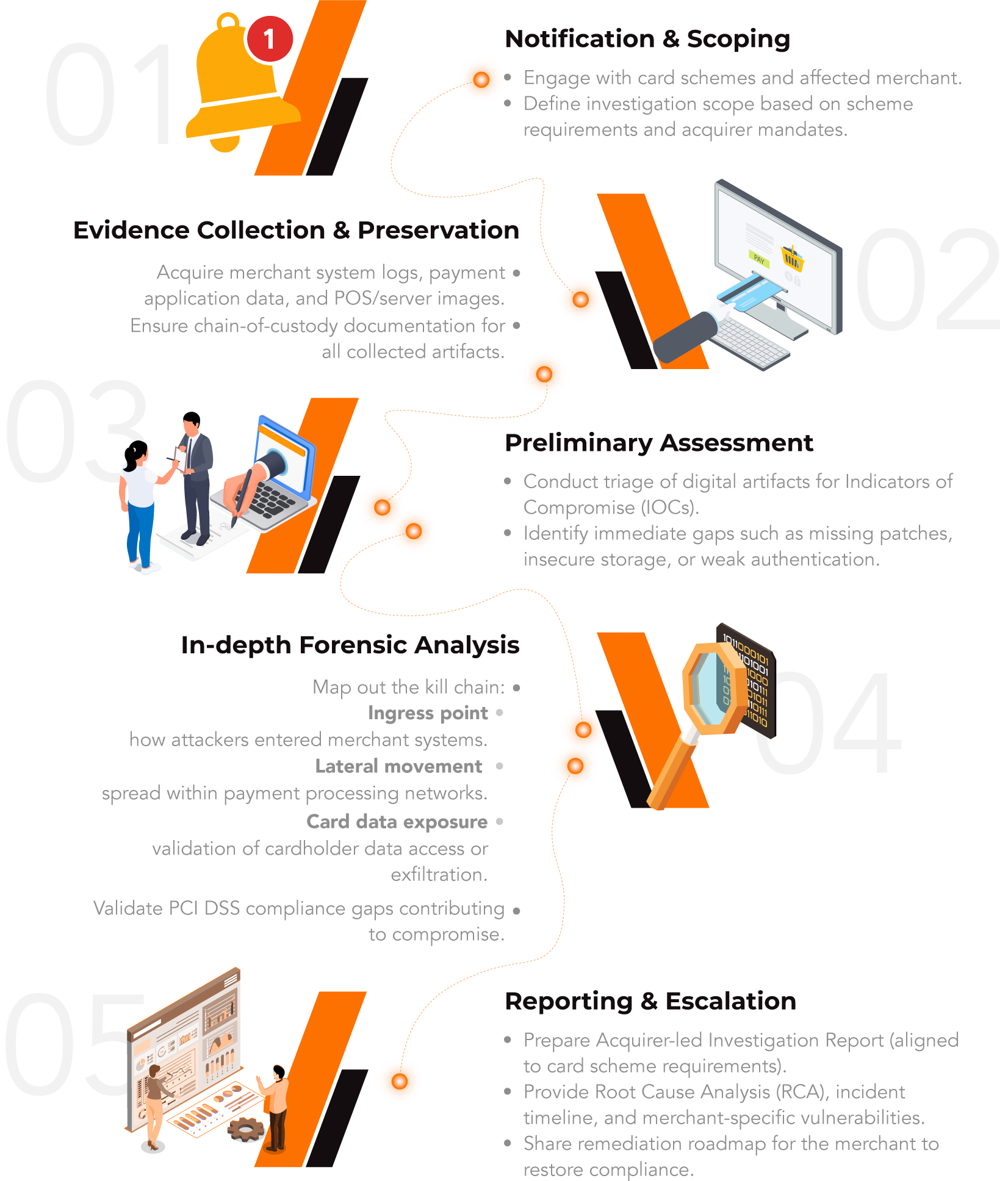

From Detection to Resolution: How SISA Sappers Supports Acquirers

SISA Sappers assist acquiring banks with structured forensic methodology to investigate, validate, and report on incidents with regulatory alignment. The process combines technical depth with business clarity to ensure defensible outcomes for both acquirers and card schemes.

Key Outcomes of an Acquirer-led Investigation

Acquirer Investigation Report

Structured findings for submission to card schemes.

Root Cause Analysis (RCA)

Identification of vulnerabilities and entry vectors.

Incident Timeline

Step-by-step reconstruction of the attack.

Evidence Pack

Forensically preserved artifacts to support regulatory review.

Merchant Compliance Assessment

PCI DSS gaps mapped to the incident.

Remediation Recommendations

Actionable steps to secure systems and reduce acquirer liability.

Why Acquirers trust SISA and Sappers

Proven acquirer

engagement

Extensive experience in supporting acquirers during scheme-driven investigations.

Card scheme

alignment

Findings and reports accepted across Visa, Mastercard, Amex, and RuPay networks.

Forensic

depth

Expertise in, memory forensics, malware detection, and log correlation.

Regulatory

credibility

Evidence and reports defensible in card scheme audits and regulatory reviews.

Rapid

turnaround

Accelerated investigation and reporting to meet strict scheme timelines.

Merchant ecosystem

expertise

Familiarity with diverse merchant environments including retail, e-commerce, hospitality, and payment processors.

Notified by a card scheme of potential merchant compromise?

Engage SISA’s Acquirer-led Investigation experts to secure evidence, validate exposure, and ensure timely compliance reporting.

USA

USA India

India APAC

APAC Middle East

Middle East Global

Global

Facebook

Facebook Linkedin

Linkedin  X

X Youtube

Youtube